close [ x ]

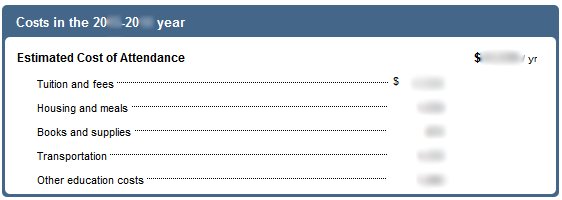

Your Estimated Cost of Attendance (COA) is the Office of Student Financial Aid Services’ estimate of your educational expenses to attend UConn for the academic year (for the fall semester plus the spring semester).

Your actual cost may be more or less based on your personal choices. The COA is calculated based on the assumption that you will be attending UConn as a full-time student.

It does not include some fees that are course-specific (e.g., lab fees, educational materials, art supplies, etc.).

Additional details regarding the COA are available at http://financialaid.uconn.edu/cost/

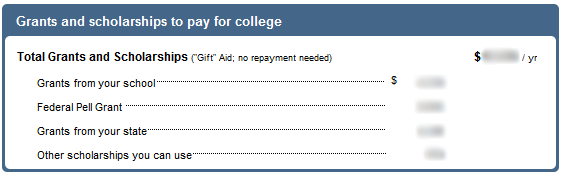

Grants from your school - this amount includes both grants and scholarships that have been awarded to you by UConn. These may include grants from federal, state, and institutional sources (other than Federal Pell Grant, which is listed separately).

Other scholarships – These are awards you are bringing with you to UConn about which the Office of Student Financial Aid Services has been notified.

Grants from your state - this amount includes grants and scholarships that have been awarded to you by the Department of Higher Education (or the equivalent) in your state

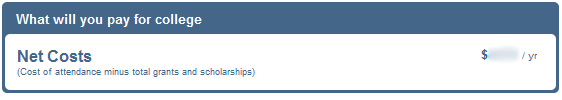

Your Net Costs are calculated by subtracting the Total Grants and Scholarships amount from the Total Estimated Cost of Attendance. It is important to remember that this amount is an estimate, as the Total Estimated Cost of Attendance includes many non-billed expenses. While an estimate of overall costs is useful for budgeting, the interactive financial aid worksheet will assist in calculating the amount due to UConn.

Work Options – If you have been awarded Federal Work-study as part of your financial aid package, it will be listed here. Other work options are available as well.

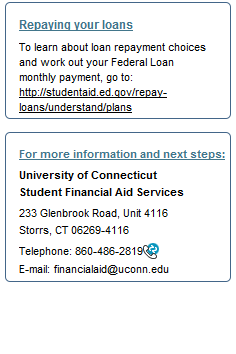

Loan Options – The amounts displayed on the shopping sheet represents the amount of each loan for which you are eligible. These numbers represent the maximum amount you may borrow, based on your Estimated COA. Examine your actual expenses as well as all resources when creating your budget to determine how much (if any) loan funding you elect to pursue. The Office of Student Financial Aid Services recommends that students borrow only the full amount that is absolutely needed for the school year.

Other Options – Your Expected Family Contribution (EFC) is the indexed amount calculated based on the information you reported on your Free Application for Federal Student Aid (FAFSA). The EFC is used by schools to calculate how much and what types of financial aid you are eligible to receive.

Also listed in this section are additional options with which students may meet college expenses. Your situation and eligibility for listed items and programs will vary.

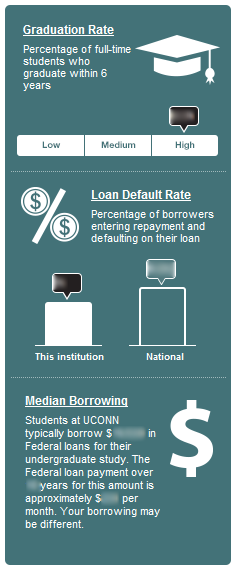

The blocks on the right-hand side of the Shopping Sheet offer the latest averages for graduation rate, loan default, and loan borrowing. These numbers are indications. As with any average, there are those students who are below these marks and others who are above them.

It is important to work closely with your academic advisors and other college personnel to understand your degree requirements and map out a plan to achieve your goals in the shortest amount of time. Whether you are going full-time or part-time, ensuring you are taking only those classes you need and doing so in an appropriate sequence will insure academic success and a speedy graduation.

Loan borrowing should be kept at a minimum. Doing so will make for more manageable monthly loan repayments and will help you to avoid default. As well, statistics show that the students who do not complete their degree or work closely with their loan servicing agencies when they are having financial difficulty are more likely to default on their loan payments. Loan servicing agencies will help you avoid default and the negative consequences of having a federal loan default on your credit report.